Hi and welcome thanks for taking the time to watch this video. My name is Thom Ryan with Provider Outreach and Education at WPS Government Health Administrators. I'm here to help you understand this video and its content. This is an instructional video to help you complete section four of the CMS form 855I for physician and non-physician practitioners who need to make a change to their Medicare enrollment or enroll in Medicare for the first time. Section four is the business information for the individual taking an enrollment action with Medicare. Not all enrollment actions require an individual to complete section four. So, let's begin by determining if section four needs to be completed. To determine if you need to complete section four, begin by moving to section 1A on page 4. This section allows you to choose what options you're going to do with your enrollment record. This is why it will determine whether or not you need to complete complete section four. Read through the list. Check the box for the option you want on the left side, then move to the right side, on the same line, and note which sections you need to complete. If you need to make a change, please note, you must complete section 1B below. We'll talk about that on the next slide. Moving down on page four you'll locate section 1B. Here you'll also select an option for which change you need to make to your provider enrollment record. After selecting the option, move to the right side of the corresponding line and note the sections that need to be complete. Answer the question, is section 4 on the required list of sections to complete? Let me give a few examples to help you determine if you need to complete section 4. The first option listed is to change your personal identifying information. If you note, on this row, section four is...

PDF editing your way

Complete or edit your fillable forms anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export irs fillable pdf forms directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your tax filing online as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your irs fillable forms by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about Irs printable tax forms

- IRS printable tax forms include form 1040.

- Online tax return filing is available.

- IRS PDF fillable forms are accessible.

Award-winning PDF software

How to prepare Irs printable tax forms

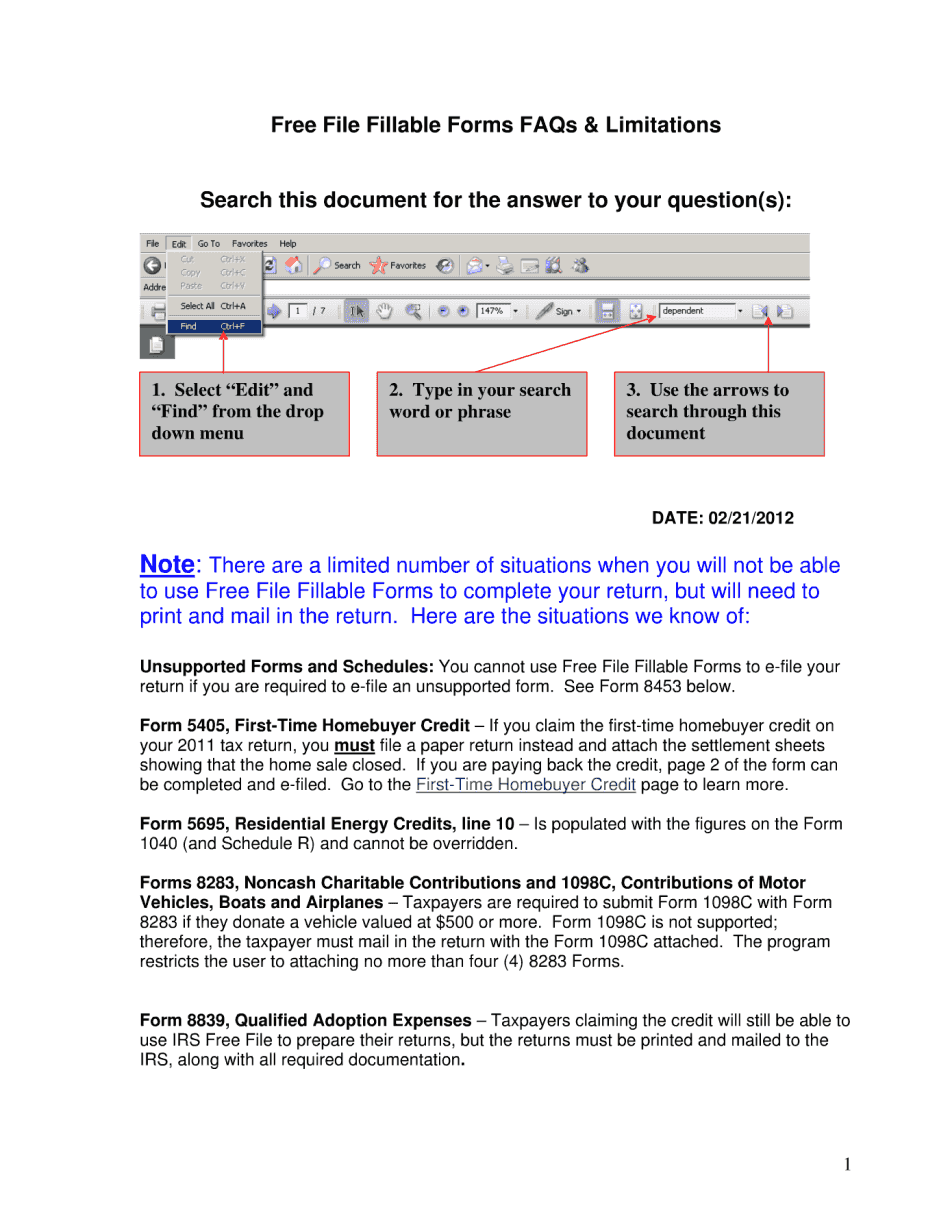

About Form 4F FAQs & Limitations

Form 4F FAQs & Limitations refers to a set of frequently asked questions and limitations concerning a specific form used for the submission of a notice of transfer of ownership or other interest in securities registered under the Securities Act of 1934. This form is required by the Securities and Exchange Commission (SEC) and must be submitted by any person or entity that is subject to the reporting requirements of the Securities Act of 1934. This includes directors, officers, and beneficial owners of securities that are registered under the Act. The Form 4F FAQs & Limitations provide guidance and clarification on the requirements and limitations of using the form, including the types of transactions that can be reported, the timing of reporting, and certain restrictions on the use of the form. Some of the limitations of the form include restrictions on the reporting of transactions involving exempt securities, certain derivative securities, and transactions that occur outside of the United States. In summary, anyone subject to the reporting requirements of the Securities Act of 1934 who is involved in a transaction involving the transfer of ownership or other interest in registered securities may need to complete and submit the Form 4F, and should consult the Form 4F FAQs & Limitations to ensure compliance with SEC rules and regulations.

People also ask about Irs printable tax forms

What people say about us

How to complete forms without mistakes

Video instructions and help with filling out and completing Irs printable tax forms